Can I File Head of Household if My Family Member Has a Dependent

Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesn't affect our editors' opinions. Our 3rd-party advertisers don't review, approve or endorse our editorial content. It's accurate to the all-time of our knowledge when posted.

Advertiser Disclosure

Nosotros think information technology'due south important for you to sympathise how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we brand helps us give you lot admission to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what society). But since nosotros mostly make coin when you detect an offer you like and get, we attempt to show you offers we think are a good match for you. That's why we provide features similar your Approval Odds and savings estimates.

Of grade, the offers on our platform don't represent all financial products out in that location, just our goal is to show you equally many great options as we can.

This article was fact-checked past our editors and Jennifer Samuel, senior product specialist for Credit Karma Tax®. It has been updated for the 2020 tax year.

Choosing the wrong filing status is one of the most common errors people make on tax returns, according to the IRS.

Like many other aspects of taxes, choosing a filing status can be confusing — peculiarly if more one can apply to you. For example, if you're not married, y ou might call back you should merits the unmarried filing condition. But what if yous take at least 1 dependent?

You may be able to claim the head-of-household filing status on your federal return, which could score you a lower tax rate, a smaller taxation liability and bigger tax refund (if you're due i) than yous would get by filing every bit single.

So how can you qualify to file as head of household? Allow's take a look at the requirements and advantages of this filing status.

- What'due south a filing status and why does it affair?

- Who tin file every bit head of household?

- Who counts as a qualifying person for head-of-household purposes?

- What are some taxation benefits of filing as head of household?

- What if I filed single when I could have filed as head of household?

What's a filing status and why does it matter?

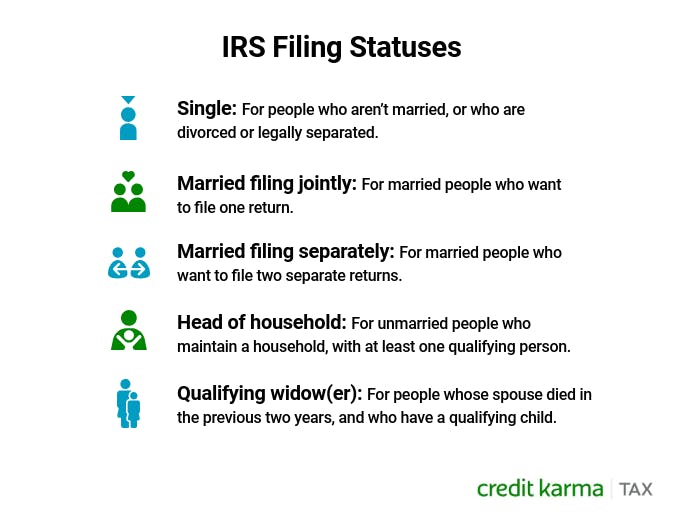

A filing status is a designation that tells the IRS some very important information about you, including whether you're married, single or widowed, and whether you have dependent children. Your filing status helps make up one's mind your tax rate, what tax subclass you stop upwardly in, the amount of tax you owe, your standard deduction, eligibility for certain credits and even if y'all have to file at all.

Choosing the wrong filing condition could leave yous paying far more than in taxes than y'all should. Here are the filing statuses the IRS recognizes.

Image: txupdatehoh

Image: txupdatehoh Who can file every bit caput of household?

You can encounter from the above chart that filing status is generally tied to marital condition, with married taxpayers having the selection to file jointly or separately. Generally, people who have never been married, or who are legally divorced or separated at the end of a revenue enhancement year, should use the single filing condition.

But some unmarried taxpayers can use the head-of-household filing status. But you must meet certain requirements, including the post-obit:

- You were single or considered unmarried on the terminal solar day of the tax year.

- Yous paid more than than half the cost of maintaining a household for the tax year.

- Yous had at least one qualifying person living with you for more half the tax twelvemonth (except for temporary absences, like attending college). Notation: Qualifying dependent parents don't have to live with you.

Hither's an example of how the qualifying toll of maintaining a home works: Your eighteen-year-one-time son lived with you and paid half of all the household bills. You tin can't merits the head-of-household filing condition. Yous tin only claim head of household if you lot paid more than half, which would be 51% or more of your total household expenses.

Once you've established that y'all paid more than fifty% of the expenses of your abode, yous must too meet all the requirements for your qualifying person that you claim every bit your dependent.

Who counts every bit a qualifying person for head-of-household purposes ?

To file head of household, y'all must have a qualifying dependent. A qualifying person may be …

- Your qualifying child, like a son, girl or grandchild who lived with you more than than half the year and meets sure other criteria. (More than on this in a moment.)

- Your dependent mother or father.

- A qualifying relative other than a parent (like a sibling or grandparent) who lived with you more than half the year and is your dependent. (More on this, besides.)

Your qualifying person can't be someone else'due south qualifying person who enables them to file as head of household for the aforementioned tax year.

Qualifying child tests

To be considered equally qualifying, a kid must meet 5 tests.

- Relationship test — To see the relationship test, a child must be your child, stepchild, foster child, grandchild, sibling, step- or half-sibling, niece, nephew, or adopted child.

- Age test — Your child must exist younger than you, and younger than 19 at the stop of the year. If your child is in higher, they tin can withal be considered as qualifying (until age 24). And if your child is permanently disabled, they qualify regardless of their historic period.

- Residency exam — To meet this exam, your kid must have lived with you for more half the year. Some situations may qualify every bit exceptions, or reasons why your child didn't live with yous, that will still let you to merits them.

- Support exam — Your kid didn't provide more than half of their own support for the yr.

- Joint render examination — If your qualifying child is married, they tin't have filed a joint return with their spouse unless it was to claim a refund of income tax withheld or estimated tax they paid.

Qualifying relative test

What if yous don't take a child to qualify equally your dependent, but y'all have a family member who lived with you more half the year?

A qualifying relative can be any historic period and tin can be considered as a dependent who helps you authorize for the head-of-household filing status by coming together iv tests.

- Not-a-qualifying-child test — The relative isn't your qualifying kid or the qualifying child of another taxpayer. For example, you have an developed child who doesn't see the age test to exist a qualifying child, but they may meet the other tests to be considered a qualifying relative.

- Gross income exam — Your qualifying relative can't accept gross income of a certain corporeality for the tax year. Income includes money, property and services that aren't exempt from tax. There are exceptions and this limit may alter from year to year .

- Member-of-household or human relationship test — Anyone who lives with you all year equally a member of your household can meet this test, even if they're not related to y'all. If the person is your child, stepchild or foster child, they may also meet this exam, even if they didn't live with you all year. Same goes for other relatives: grandchildren; siblings, one-half-siblings or step-siblings; parents, in-laws, pace-parents and grandparents; nieces and nephews; and aunts and uncles.

- Support test — By and large, y'all must accept provided more than half of your qualifying person'south total back up during the year for them to meet this test.

What are some revenue enhancement breaks for parents?

What are some tax benefits of filing every bit head of household?

Filing as head of household has advantages over the unmarried or married-filing-separately statuses, including the following:

- A lower tax rate — Mostly, the income thresholds for caput of household filers are higher than for single filers. That means more of your income can be taxed at a lower rate if you can file as head of household. For example, for 2019 single filers moved from the 10% tax rate (the lowest) to 12% when their income exceeded $nine,700. For caput of household filers, that threshold was $thirteen,850.

- A higher standard deduction — The standard deduction for head of household is $18,650 for 2020 versus $12,400 for single filers. Like all tax deductions, the standard deduction helps reduce your taxable income, which in turn may reduce your taxation liability.

- Access to certain credits — For example, by filing as head of household, yous can claim the child revenue enhancement credit for your qualifying kid.

What if I filed single when I could accept filed as head of household?

If yous filed a contempo federal render as single when you qualified to use the caput-of-household condition, all is not lost.

You tin probable correct your filing status for the tax year — and merits whatever tax advantages you missed — by filing an amended tax return . There's a place on Form 1040-Ten where you can change your filing condition. Just be aware that if you alter your filing status to head of household, you lot'll need to include the name of any qualifying kid who is not your dependent. In that location's as well a section where you'll need to explain why you're filing the amended return.

Lesser line

As y'all can encounter, filing as head of household has its advantages — if you're a unmarried person and tin can meet the tests and qualifications. It's certainly not as restrictive every bit the married-filing-separately status, which limits certain credits and deductions. By filing as head of household, you may be able to claim deductions and credits non available to single filers or those married filing separately.

Still not certain you qualify to file every bit caput of household? The IRS offers an interactive banana to help you choose a filing status. And Credit Karma Tax® can also walk you through the process of selecting a filing status when you use the free tax-filing service.

Relevant sources: IRS: Publication 17 — Your Federal Income Taxation | IRS: SOI Tax Stats — Private Income Tax Returns Publication 1304 (Consummate Report) | IRS: Choosing the Correct Filing Status | IRS: What Is My Filing Status? | IRS: Publication 501 (2019), Dependents, Standard Deduction and Filing Information

Jennifer Samuel, senior revenue enhancement production specialist for Credit Karma Tax®, has more than a decade of feel in the revenue enhancement grooming industry, including work as a tax analyst and tax preparation professional. She holds a bachelor's degree in accounting from Saint Leo University. You lot tin find her on LinkedIn.

Source: https://www.creditkarma.com/tax/i/how-to-file-as-head-of-household

0 Response to "Can I File Head of Household if My Family Member Has a Dependent"

Post a Comment